Managing debt can feel overwhelming, but with the right tools, it becomes much simpler. A well-structured Debt Repayment Checklist can guide you step by step through the process, helping you stay organized and motivated. In this article, we’ll explore everything you need to know about creating and using a Debt Repayment Checklist, including its advantages, best practices, and opportunities for improvement.

What is a Debt Repayment Checklist?

A Debt Repayment Checklist is a practical tool designed to help you track and manage your debt repayment journey. This checklist simplifies the process by breaking down each repayment step, such as identifying debts, setting priorities, and tracking progress. Whether you’re managing personal debt or overseeing a business’s financial obligations, this checklist ensures that no detail is overlooked.

Key Features of the Debt Repayment Checklist

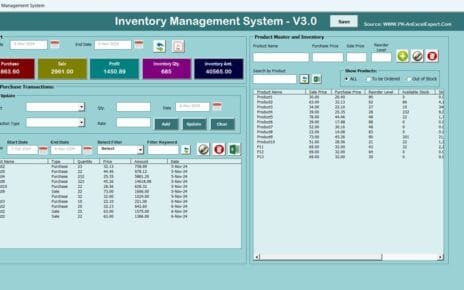

Our Debt Repayment Checklist Template is designed with simplicity and functionality in mind. It includes two worksheets to help you stay on top of your repayments and make adjustments as needed.

Debt Repayment Checklist (Main Worksheet)

This primary worksheet is where all your debt-related tasks are recorded and monitored.

Top Section Highlights:

- Total Count: Displays the total number of tasks in your checklist.

- Checked Count: Tracks the number of completed tasks.

- Crossed Count: Highlights incomplete or irrelevant tasks.

- Progress Bar: Gives you a quick overview of your progress in percentage form.

Checklist Table:

The checklist table captures essential details for each task:

- Serial No.: Automatically generated for easy reference.

- Checklist Item: Describes the task to be completed.

- Description: Provides additional information about the task.

- Responsible Person: Indicates who is in charge of completing the task.

- Deadline: Specifies the due date for each task.

- Remarks: Allows for notes or updates about the task.

- Status: Use ✔ for completed tasks and ✘ for tasks still pending.

List Sheet Tab

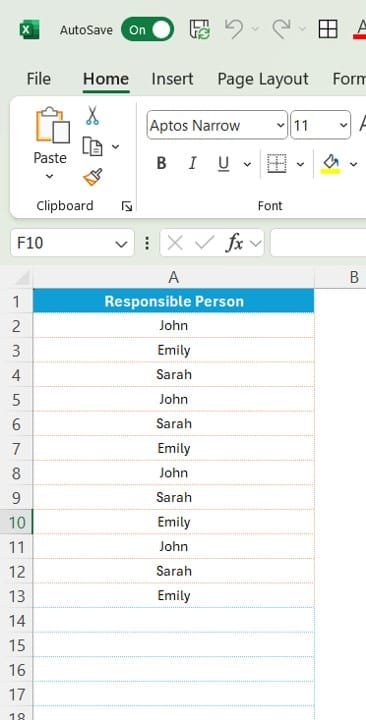

The secondary worksheet functions as a repository for unique values, such as the list of responsible persons. This sheet is particularly helpful for creating drop-down menus, ensuring consistency, and reducing manual errors.

Advantages of a Debt Repayment Checklist

Using a Debt Repayment Checklist offers several benefits that can make managing your finances much easier:

- Clarity and Organization: It provides a clear roadmap, breaking down the repayment process into manageable steps.

- Reduced Errors: By tracking each task, you minimize the risk of overlooking important details like due dates or specific payments.

- Accountability: Assigning tasks to specific individuals ensures responsibility and prevents delays.

- Better Decision-Making: With all your debt details in one place, you can make informed decisions about prioritization and resource allocation.

- Motivation Through Progress Tracking: Seeing your progress visually, whether through a progress bar or checked tasks, keeps you motivated to stick to your repayment plan.

Best Practices for Using a Debt Repayment Checklist

To maximize the benefits of your checklist, follow these best practices:

- Customize the Checklist to Your Needs: Adapt the template to reflect your unique financial situation. Add specific tasks, deadlines, or columns as needed.

- Review and Update Regularly: Debt management isn’t static. Regularly update your checklist to reflect changes, such as new debts or adjusted repayment plans.

- Set Realistic Deadlines: Ensure that deadlines are achievable to avoid unnecessary stress or missed payments.

- Use Automation Wherever Possible: Incorporate formulas, conditional formatting, or macros to streamline processes like progress tracking or status updates.

- Celebrate Small Wins: Acknowledge progress, no matter how small. Celebrating milestones can keep you motivated throughout your repayment journey.

Opportunities for Improvement in Debt Repayment

Even with a well-structured checklist, there’s always room to refine the process. Here are some opportunities for improvement:

- Enhance Automation: Integrate tools like Google Sheets or Excel macros to automate reminders for upcoming payments or overdue tasks.

- Collaborate in Real Time: If multiple people are responsible for debt repayment, use collaborative tools like shared spreadsheets to work together seamlessly.

- Incorporate Financial Analysis: Add a column to calculate the total interest saved by paying off debts early, which can help motivate you to prioritize high-interest debts.

- Monitor and Adjust: Regularly analyze your checklist to identify bottlenecks or inefficiencies, and adjust your plan accordingly.

Why Choose Our Debt Repayment Checklist Template?

Our ready-to-use template simplifies debt management by providing:

Two comprehensive worksheets for organized data tracking.

User-friendly features, including drop-down menus and progress tracking.

Customizable options to suit your specific needs.

Automation tools for seamless updates and real-time collaboration.

By using this template, you’ll save time, reduce stress, and stay on track with your repayment goals.

How to Create Your Own Debt Repayment Checklist

If you’d like to build a custom checklist, follow these simple steps:

Step 1: Plan Your Structure

Identify the tasks needed for effective debt management, such as listing debts, setting priorities, and tracking payments.

Step 2: Create Essential Columns

Set up columns like:

- Serial No.

- Checklist Item

- Description

- Responsible Person

- Deadline

- Remarks

- Status (✔ or ✘)

Step 3: Add Progress Tracking

Use formulas to calculate totals, completed tasks, and overall progress percentage.

Step 4: Automate Drop-Down Menus

Create a secondary sheet to store unique values for fields like Responsible Person. Link these to the main checklist for easy selection.

Step 5: Test Your Checklist

Run through a few example scenarios to ensure the checklist functions smoothly and covers all necessary tasks.

Frequently Asked Questions (FAQs)

- What is the primary purpose of a Debt Repayment Checklist?

This checklist helps you stay organized, prioritize tasks, and track your progress during your repayment journey.

- How do I customize the checklist for my needs?

You can add or modify columns, include specific repayment tasks, or use automation tools like Excel macros to simplify updates.

- Can I use this checklist for personal and business debt?

Absolutely! The checklist is versatile and can be adapted for both personal and business debt management.

- How often should I update the checklist?

Review and update the checklist weekly or whenever there’s a change in your financial situation.

- How can I track overdue payments?

Use conditional formatting to highlight overdue tasks in red, making them easy to spot at a glance.

- Is it possible to share the checklist with others?

Yes, by using cloud-based tools like Google Sheets, you can share and collaborate in real time.

Conclusion

A Debt Repayment Checklist is more than just a tool—it’s your roadmap to financial freedom. By organizing your tasks, tracking your progress, and staying consistent, you can manage debt with confidence and clarity. Whether you’re tackling personal loans or managing business obligations, this checklist keeps you on track and motivated.

Visit our YouTube channel to learn step-by-step video tutorials

View this post on Instagram