Unlock the immense potential of your banking data with a state-of-the-art Banking KPI Dashboard in Power BI. This comprehensive guide will walk you through the robust capabilities of this dashboard, demonstrating how it can revolutionize the way you monitor key performance indicators (KPIs) and enhance strategic decision-making within the banking sector.

Click to Banking KPI

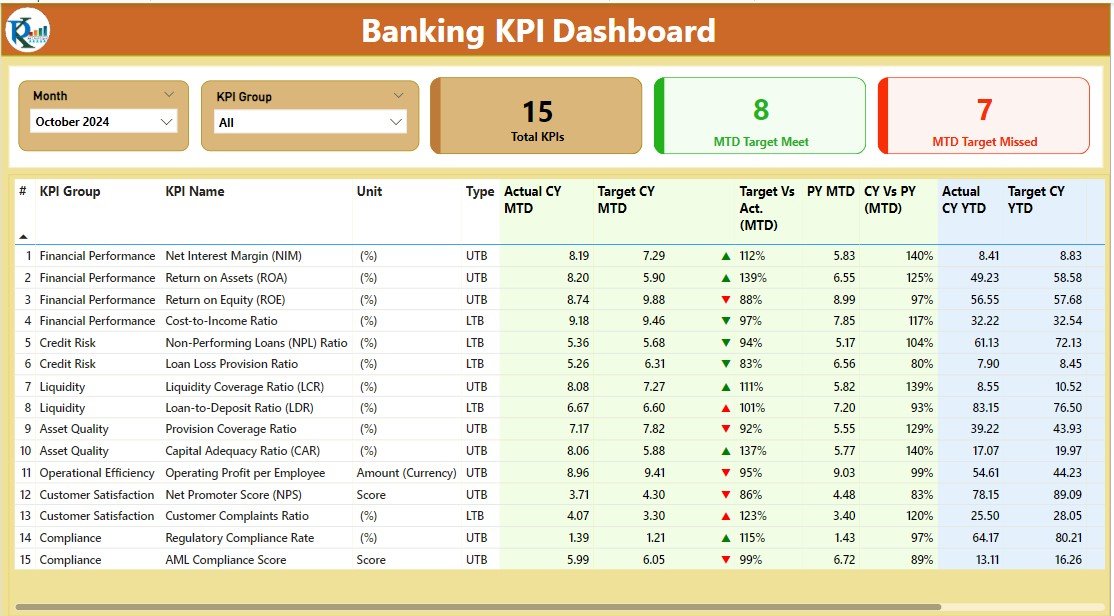

Understanding the Banking KPI Dashboard in Power BI

At its core, a Banking KPI Dashboard in Power BI is an advanced tool crafted to present critical banking metrics in an accessible and actionable format. This dashboard seamlessly integrates data from Excel, providing a real-time perspective on financial performance across a variety of metrics.

Key Features of the Banking KPI Dashboard

Three-Page Layout: The dashboard includes a Summary Page, a KPI Trend Page, and a concealed KPI Definition Page for in-depth analysis.

Interactive Components: Employ slicers and dynamic icons to sift through data and visualize how well performance measures up against set targets.

Click to Banking KPI

Setting Up Your Banking KPI Dashboard

- Preparing Your Excel Data

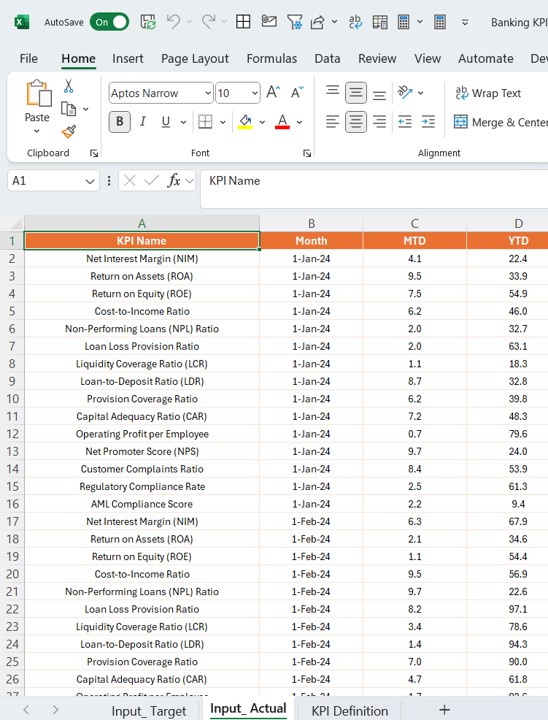

Input Actual Sheet:

- Here, you need to input actual figures for KPIs, capturing monthly data, MTD (Month-to-Date), and YTD (Year-to-Date) numbers.

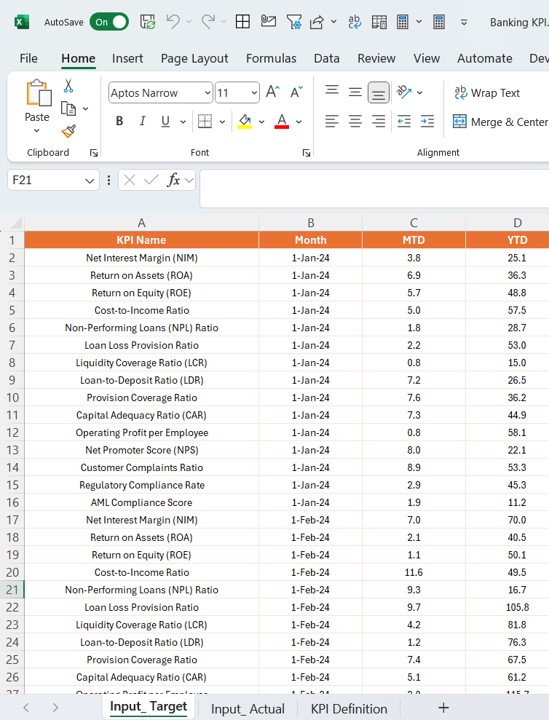

Input Target Sheet:

- This sheet should mirror the actual figures with corresponding target data for a detailed performance comparison.

Click to Banking KPI

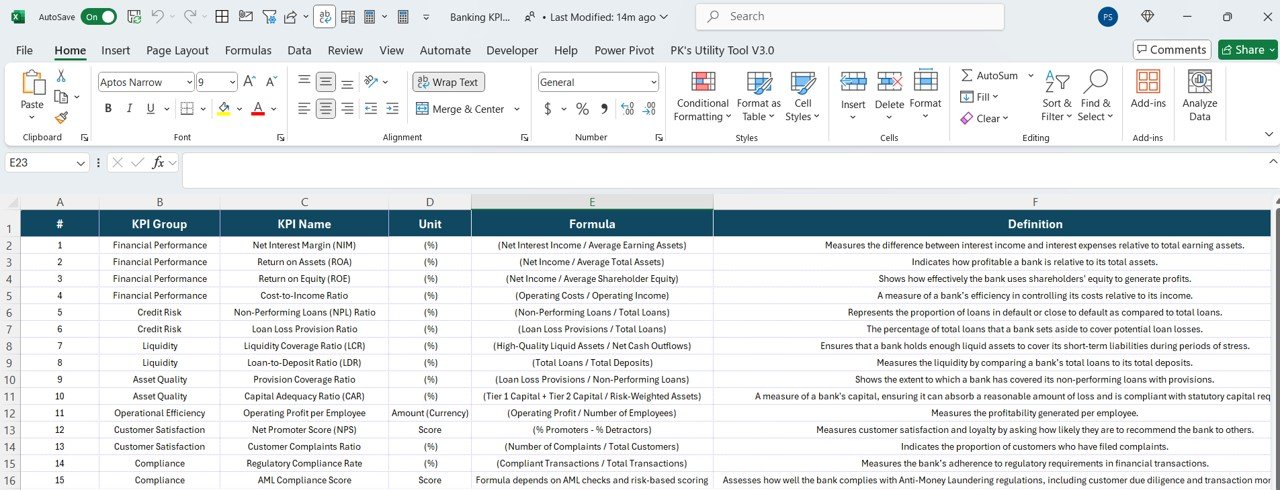

KPI Definition Sheet:

- Clearly define each KPI by its number, group, name, unit, formula, definition, and type—whether it’s LTB (Lower the Better) or UTB (Upper the Better).

Integrating with Power BI

Data Importation:

- Transfer your meticulously prepared Excel files into Power BI to forge a dynamic, interactive dashboard.

Dashboard Setup:

- Arrange your dashboard pages to showcase summary insights, analyze trends, and provide detailed KPI definitions through drill-through capabilities.

Click to Banking KPI

Advantages of the Banking KPI Dashboard in Power BI

- Enhanced Decision Making: Immediate access to key financial metrics significantly aids in swift and informed decision-making.

- Real-Time Data Analysis: Keep a close watch and compare current performance against historical data and predefined targets.

- Adaptable Views: Customize your dashboard to spotlight the most critical information pertinent to your role or department.

Best Practices for the Banking KPI Dashboard

- Frequent Updates: Ensure your data sources are regularly updated to maintain accuracy in your reports.

- Comprehensive User Training: It’s essential to educate users on how to effectively interact with the dashboard to fully leverage its capabilities.

- Robust Security Measures: Implement stringent data security protocols to safeguard sensitive financial information.

Conclusion

Click to Banking KPI

The Banking KPI Dashboard in Power BI turns complex data sets into actionable insights, empowering banking professionals to achieve enhanced operational efficiency and strategic alignment in their financial activities.

Frequently Asked Questions

Q. How can I customize my dashboard for different user roles?

You can tailor the dashboard by configuring user access to various pages and elements based on specific roles, ensuring that only pertinent data is visible to each user.

Q. What are the common challenges when setting up the dashboard?

Some of the typical hurdles include issues with data integration, maintaining data accuracy, and the necessity to ensure that all users are adept at utilizing the dashboard.

Q. Is it possible to share the dashboard with external stakeholders?

Absolutely, Power BI provides secure sharing options. However, always ensure compliance with your organization’s data governance and privacy policies when sharing sensitive information.

Click to Banking KPI

Visit our YouTube channel to learn step-by-step video tutorials

View this post on Instagram