In today’s fast-paced financial world, organizations must maintain a robust debt management system to ensure smooth operations and prevent financial strain. Debt management involves efficiently handling the company’s liabilities and ensuring timely payments. One of the most powerful tools for achieving this is a Debt Management KPI (Key Performance Indicator) Dashboard. This dashboard provides an organized and visual representation of crucial financial metrics, allowing businesses to track their debt-related performance with ease.

In this article, we will explore the features of a Debt Management KPI Dashboard, how it can improve financial monitoring, and how to effectively use it to monitor key metrics. Additionally, we will provide a comprehensive list of KPIs, including their units, formulas, and definitions, as well as whether lower or upper values are better.

What is a Debt Management KPI Dashboard?

A Debt Management KPI Dashboard is a visual tool designed to help businesses track and monitor the key performance indicators (KPIs) that relate to managing debt. This dashboard aggregates financial data to track current and historical debt levels, assess debt repayment performance, and evaluate financial goals.

By utilizing KPIs, businesses can monitor the health of their debt portfolio, identify potential risks, and make data-driven decisions to optimize debt management strategies.

Key Features of the Debt Management KPI Dashboard

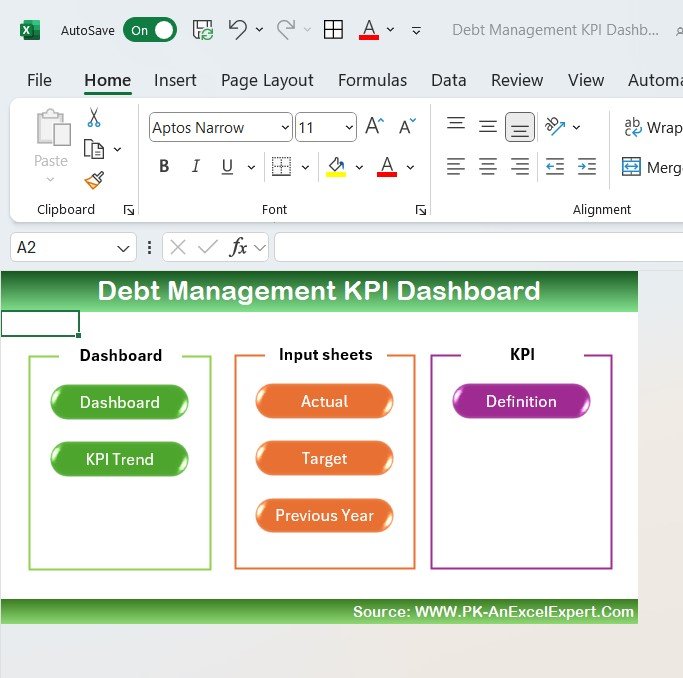

The Debt Management KPI Dashboard consists of several key features that enhance its functionality and ease of use. This ready-to-use template is designed for tracking debt KPIs across various departments or projects. Here are the seven worksheets included in the template:

1. Home Sheet

The Home Sheet is the index sheet, serving as the entry point for users. It contains six buttons that allow quick navigation to other sections of the dashboard, providing easy access to the key data points.

Click to Debt Management KPI

2. Dashboard Sheet Tab

This is the primary worksheet in the Debt Management KPI Dashboard. The Dashboard Sheet Tab displays all the essential debt-related KPIs. The key features here include:

- Month Selector: In cell D3, users can select a month from a drop-down list. This action updates the entire dashboard to show data relevant to the selected month.

- MTD and YTD Data: The sheet shows Month-to-Date (MTD) and Year-to-Date (YTD) actuals, targets, and previous year’s data. Users can easily compare actual figures with the targets and the previous year’s performance.

- Conditional Formatting: For visual insights, the dashboard includes arrows (up or down) that highlight whether a KPI has performed above or below expectations.

Click to Debt Management KPI

3. KPI Trend Sheet Tab

In this sheet, users can track the trends of specific KPIs over time. By selecting the KPI name from the drop-down list in cell C3, users can view the following details:

- KPI Group: The category to which the KPI belongs.

- Unit of Measurement: The unit used for the KPI.

- KPI Type: Whether the KPI is a positive or negative indicator (i.e., upper or lower values are better).

- Formula: The formula used to calculate the KPI.

- KPI Definition: A clear definition of what the KPI represents and how it should be interpreted.

Click to Debt Management KPI

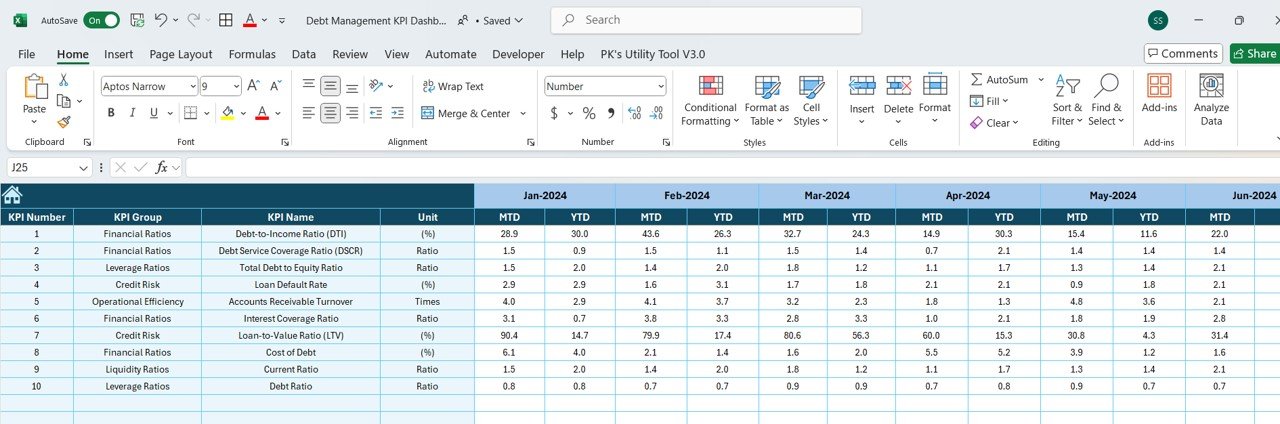

4. Actual Number Sheet Tab

Here, users enter the actual figures for the KPIs. Data for MTD and YTD is entered, allowing for precise tracking and comparisons with the targets. A drop-down list in range E1 enables users to select the month, ensuring the data reflects the correct time frame.

Click to Debt Management KPI

5. Target Sheet Tab

The Target Sheet Tab allows users to input target numbers for each KPI. It is crucial to set accurate monthly and yearly targets to assess performance effectively. This sheet supports both MTD and YTD targets, providing a comprehensive overview of debt management goals.

Click to Debt Management KPI

6. Previous Year Number Sheet Tab

For comparative analysis, this sheet requires users to enter the previous year’s figures. This enables users to measure the year-over-year performance and understand the progress made in managing debt.

Click to Debt Management KPI

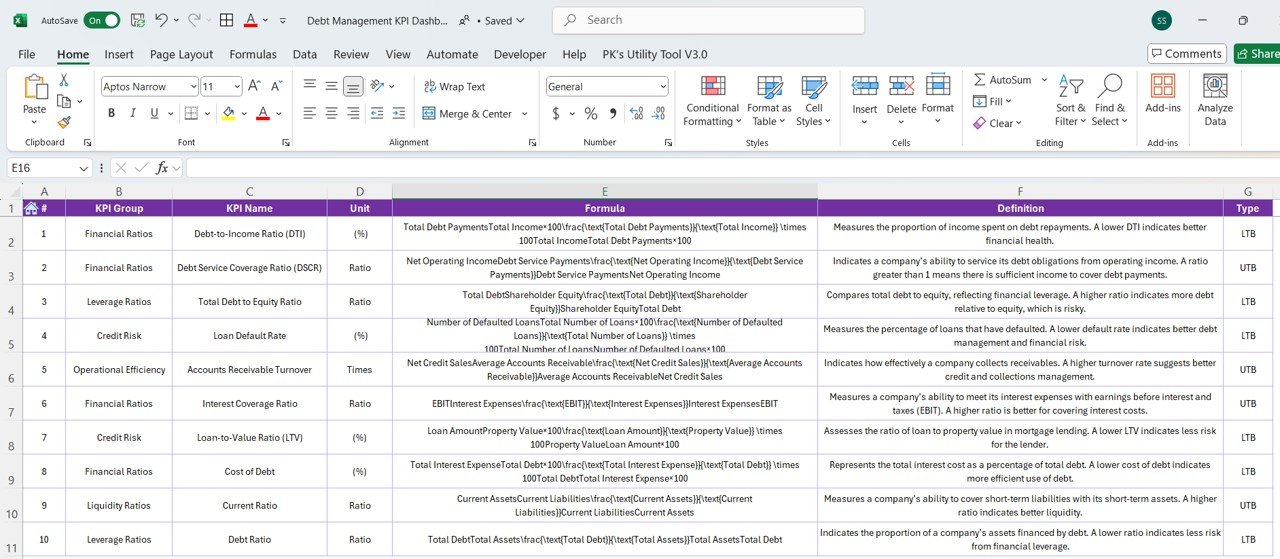

7. KPI Definition Sheet Tab

The KPI Definition Sheet Tab holds essential details about each KPI. It includes the KPI name, its group, the unit of measurement, the formula used to calculate it, and a clear definition of what it measures. This section ensures that users fully understand the KPIs and their relevance to debt management.

Click to Debt Management KPI

Advantages of Debt Management KPI Dashboards

- Improved Decision-Making: With easy-to-read KPIs, financial managers can make quick, informed decisions based on current and past performance.

- Real-Time Monitoring: The ability to update the dashboard for any given month ensures that decision-makers are always working with the latest data.

- Increased Accountability: By tracking performance against targets, employees and departments can be held accountable for managing debt effectively.

- Enhanced Financial Health: Regularly monitoring KPIs helps in identifying any financial issues early, allowing businesses to take corrective action before problems escalate.

Opportunities to Improve Debt Management with KPIs

Debt management can always be enhanced by focusing on the right metrics. Here are some opportunities for improvement:

- Accurate Data Entry: Ensuring the accurate entry of both actual and target figures helps maintain the integrity of the dashboard’s outputs.

- Refining KPIs: Continuously review the KPIs to ensure they are aligned with organizational goals and market conditions.

- Predictive Analysis: Implement predictive analytics to forecast potential debt-related issues and create proactive strategies for debt repayment.

Best Practices for Debt Management KPI Dashboards

To maximize the effectiveness of your Debt Management KPI Dashboard, consider the following best practices:

- Set Clear Targets: Make sure the targets for each KPI are realistic, measurable, and aligned with your financial objectives.

- Regular Updates: Keep the dashboard updated regularly to ensure it reflects the most accurate and relevant data.

- Visual Indicators: Use visual aids like color-coded arrows and charts to highlight trends and anomalies quickly.

- Cross-Department Collaboration: Debt management often involves various departments. Ensure that all relevant stakeholders have access to the dashboard and understand how to use it effectively.

Conclusion

A Debt Management KPI Dashboard is an invaluable tool for businesses looking to maintain financial health and manage debt effectively. By tracking key metrics, setting realistic targets, and continuously improving the data input and analysis, organizations can enhance their debt management strategy and ensure financial stability.

Frequently Asked Questions (FAQs)

1. What is the Debt Management KPI Dashboard used for?

The Debt Management KPI Dashboard is used to track key financial metrics related to debt, providing businesses with a clear picture of their debt performance and helping them make informed decisions.

2. How often should the Debt Management KPI Dashboard be updated?

The dashboard should be updated regularly—ideally on a monthly basis—so that it reflects the latest financial data and helps in making timely decisions.

3. Can the Debt Management KPI Dashboard be customized for different industries?

Yes, the dashboard can be tailored to fit the specific needs of different industries, including adjusting KPIs and their targets based on the financial strategies of the business.

4. How do I use the Debt Management KPI Dashboard for financial analysis?

Simply enter your actual figures, set your targets, and compare the data using the dashboard’s built-in comparison tools. Use the trend analysis and conditional formatting to gain insights into your financial health.

5. What are the benefits of using a Debt Management KPI Dashboard?

The dashboard allows businesses to make data-driven decisions, monitor debt-related performance in real time, and ensure that they are on track to meet their financial goals.

Visit our YouTube channel to learn step-by-step video tutorials

View this post on Instagram

Click to Debt Management KPI