An Internal Audit Checklist is an essential tool for organizations looking to boost compliance, improve operational efficiency, and manage risks more effectively. Whether you’re reviewing financial processes, internal controls, or compliance standards, a well-organized checklist helps keep the audit process streamlined, ensuring that nothing slips through the cracks. In this article, we’ll dive into what an internal audit checklist is, why it’s so useful, how to improve it, and provide you with a sample template you can use immediately.

What is an Internal Audit Checklist?

Click to buy Internal Audit

At its core, an internal audit checklist is a structured document that auditors or quality control teams use to track and assess various processes within an organization. It usually includes a list of tasks to be completed, along with details like the responsible person, deadlines, and current task status.

Internal audits are essential for ensuring that a business is following regulations, adhering to its internal policies, and operating smoothly. With a checklist, auditors can easily track progress, spot inefficiencies, and identify areas that need attention. By keeping things organized, it’s less likely that anything will be overlooked.

Key Features of an Internal Audit Checklist Template

When creating an internal audit checklist, it’s important to include certain features to make it as effective as possible. Let’s walk through some key elements you should include in your checklist.

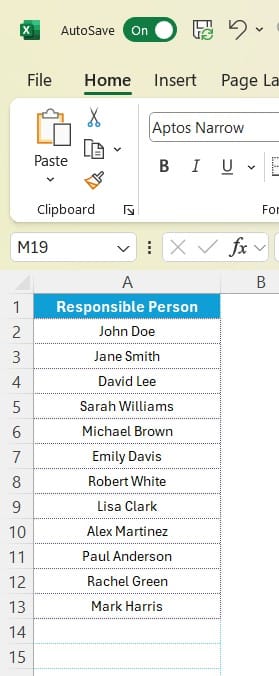

Two Worksheets for Better Structure

A good checklist template often has two main components:

- Internal Audit Checklist: This is the main sheet where you capture audit details.

- List Sheet: A separate tab that helps list the responsible individuals and allows for easy drop-down selections in the main table.

Click to buy Internal Audit

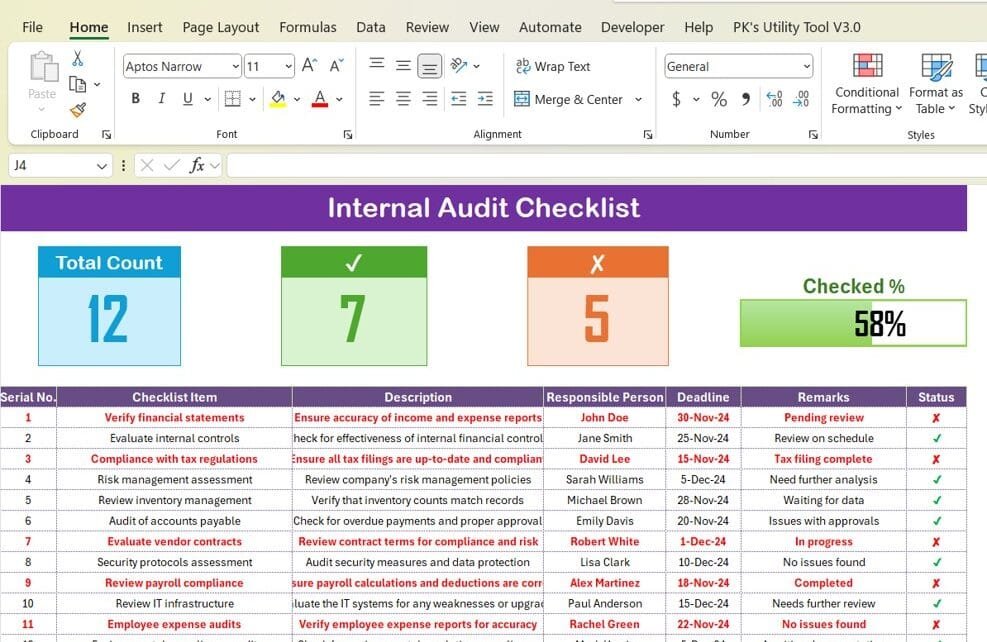

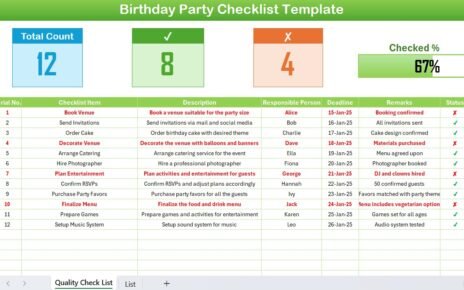

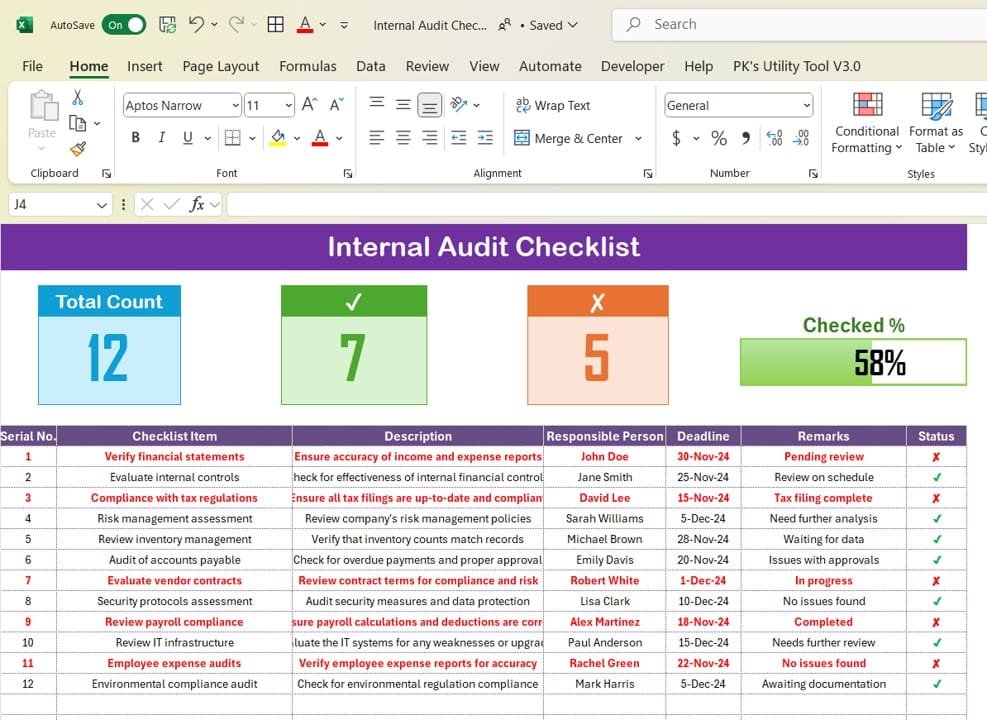

Progress Tracking Cards

At the top of the checklist, you’ll typically find some progress tracking cards. These give you a snapshot of how the audit is going:

- Total Count: Shows the total number of tasks on the checklist.

- Checked Count: Displays how many tasks are completed.

- Crossed Count: Indicates how many items are marked as incomplete.

A progress bar is also commonly included to give a visual indicator of the percentage of tasks completed. This makes it easy to track the overall status of the audit.

Checklist Table: The Heart of the Audit

The checklist table is where you’ll track individual tasks. Each task or audit item will have the following columns:

- Serial No.: A unique number for each task.

- Checklist Item: The task or process to be reviewed.

- Description: A brief explanation of what needs to be done.

- Responsible Person: Who’s responsible for completing this task?

- Deadline: The date by which the task should be completed.

- Remarks: Additional notes or observations.

- Status: Whether the task is completed (✔) or not (✘).

Click to buy Internal Audit

Advantages of Using an Internal Audit Checklist

An internal audit checklist offers several key benefits that can significantly improve how your audits are conducted. Here’s why you should use one:

- Ensures Thoroughness and Accuracy: By breaking down the audit process into smaller, manageable tasks, a checklist ensures that everything gets reviewed in detail. This minimizes the chance of overlooking important steps, improving the accuracy of your audit.

- Improves Communication and Accountability: A checklist clarifies who is responsible for each task and what the current status is, making communication between team members much smoother. This helps ensure accountability, so nothing gets missed or delayed.

- Promotes Compliance: Regular audits using a checklist help ensure that your organization stays compliant with regulations, company policies, and industry standards. This can prevent costly legal issues or penalties down the road.

- Identifies Areas for Improvement: As you go through the audit, you might discover inefficiencies, outdated practices, or areas where compliance is lacking. A checklist makes it easier to spot these issues and address them in a timely manner.

- Enhances Risk Management

An audit helps identify potential risks before they become serious problems. By evaluating things like internal controls and security measures, a checklist helps mitigate risks early on.

Opportunities for Improvement in Internal Audit Checklists

While an internal audit checklist is a powerful tool, there’s always room to improve. Here are some ways you can make your checklist even better:

- Use Automation: Manually tracking tasks and updating statuses can be time-consuming and prone to errors. Automating the checklist process with audit software can save time, reduce mistakes, and allow auditors to focus more on analysis rather than data entry.

- Add More Detailed Metrics: Rather than just marking tasks as ✔ or ✘, consider adding extra metrics like progress percentages or risk levels. This provides deeper insights into how well the audit is progressing and which tasks need more attention.

- Update Regularly: Your checklist should be a living document. Regularly update it to reflect new tasks, changing regulations, or internal process shifts. An outdated checklist can lead to missed details and an ineffective audit.

- Collaborate Across Departments: To get the most out of your audit, involve other departments (HR, IT, Compliance) in the process. A checklist that only focuses on financial controls misses the bigger picture. Collaboration ensures that all areas of the organization are covered.

- Review Feedback from Team Members: After each audit, take time to gather feedback from your team about the checklist. Are there areas that could be clearer or tasks that were difficult to track? Regular feedback helps keep the checklist useful and relevant.

Best Practices for Using an Internal Audit Checklist

To make your internal audit checklist truly effective, follow these best practices:

- Set Clear Objectives: Before you dive into the audit, make sure you have clear goals in mind. Whether it’s assessing financial compliance, operational efficiency, or risk management, having a focused objective ensures the checklist stays on track.

- Clearly Assign Responsibilities: Each task should have a designated person responsible for it. This not only ensures accountability but also helps prevent tasks from being missed or forgotten.

- Be Realistic with Deadlines: Set deadlines that are reasonable and achievable. Deadlines that are too tight might rush the audit process, while too lenient deadlines could lead to procrastination. Aim for balance.

- Keep the Checklist Organized: Organize your checklist in a logical, easy-to-follow order. Group similar tasks together, so auditors can work through related items without jumping back and forth.

- Review and Update Frequently: Finally, make it a point to review and update your checklist regularly. This keeps it relevant and ensures it reflects any changes in company processes or regulatory requirements.

Frequently Asked Questions (FAQs)

Q. What should be included in an internal audit checklist?

A good checklist includes a list of tasks, along with columns for assigned responsibilities, deadlines, and status updates. It should cover all areas of the audit, including financial reviews, internal controls, compliance, and risk management.

Q. How do I create an internal audit checklist?

Start by identifying the key areas you need to audit. Break each area down into specific tasks. Then, create a table with columns for the task, responsible person, deadlines, and status. Be sure to update it regularly as processes change.

Q. Why is an internal audit checklist important?

It helps ensure thoroughness, accountability, and transparency. It also helps spot risks and compliance issues early, improving operational efficiency and preventing costly mistakes.

Q. How do I track progress during an audit?

You can track progress by marking each task as completed (✔) or pending (✘). A progress bar can also be used to visually track the percentage of tasks that have been completed.

Conclusion

An Internal Audit Checklist is more than just a tool—it’s a way to ensure that your organization stays compliant, operates efficiently, and proactively manages risks. By following best practices and regularly updating the checklist, you can streamline the audit process, stay on top of important tasks, and address potential problems before they escalate. With the right checklist in place, audits become more effective and actionable, contributing to the overall health and success of the business.

Visit our YouTube channel to learn step-by-step video tutorials